Table of contents

I. Plastic compound market capacity in Southeast Asia

II. Market segmentation by the base resin

III. Market segmentation by application

IV. Conclusion

Along with the development of the economy, the market for plastic materials in general and plastic compounds in particular in Southeast Asia is developing more than ever in recent years. This article provides data on the Southeast Asia compound market as well as its prospects in the future to help you get an overview and make the right business decisions.

I. Plastic compound market capacity in Southeast Asia

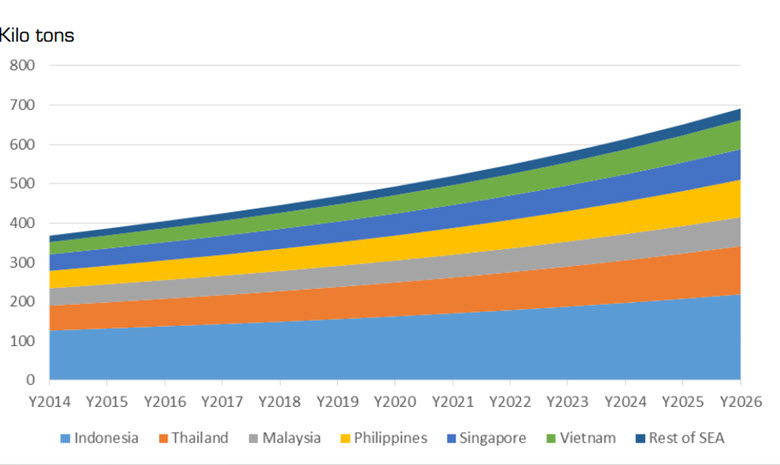

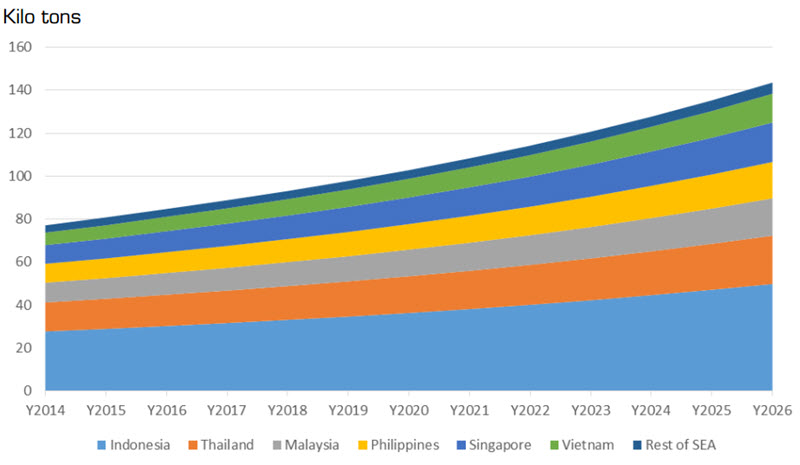

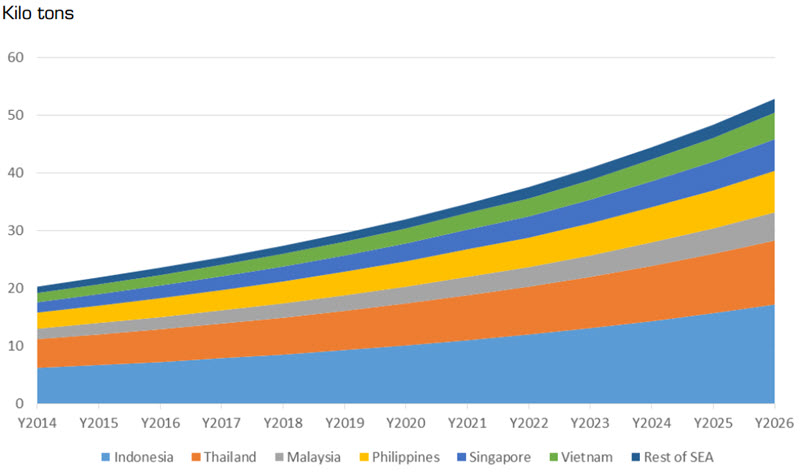

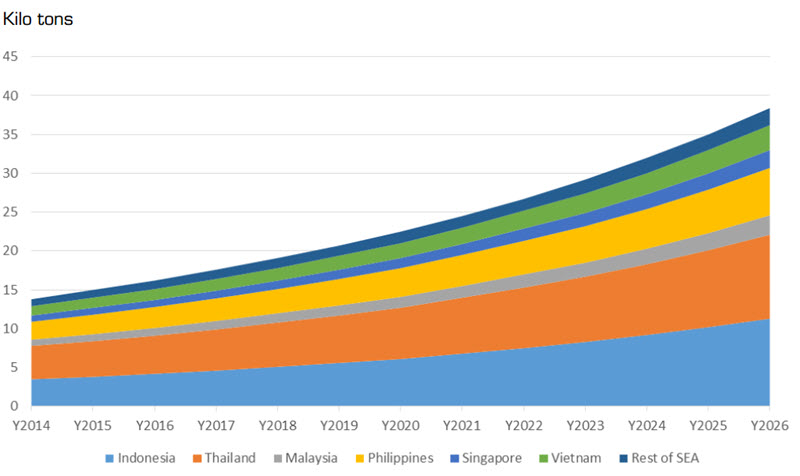

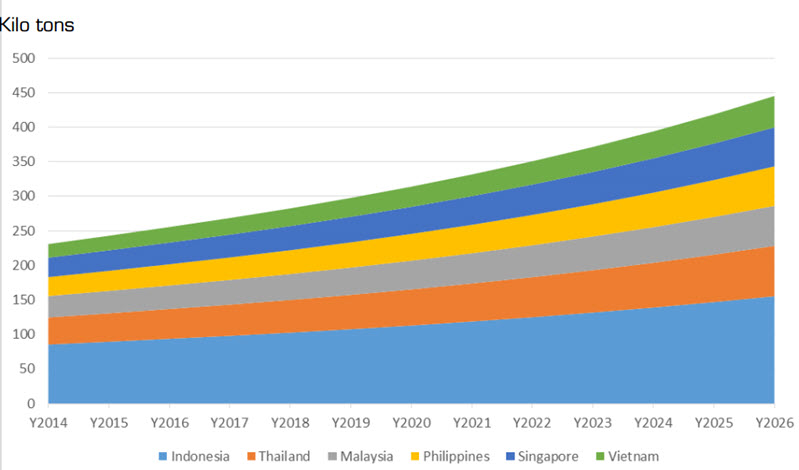

1. Volume

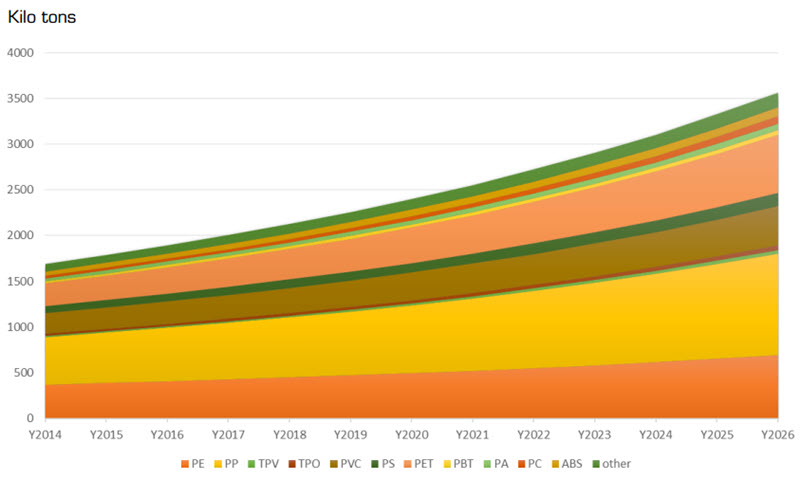

The Southeast Asian compound market is depicted through growth as shown in the figure above. The higher the color band goes to the right, the higher the speed and volume of the "expansion" of the respective market.

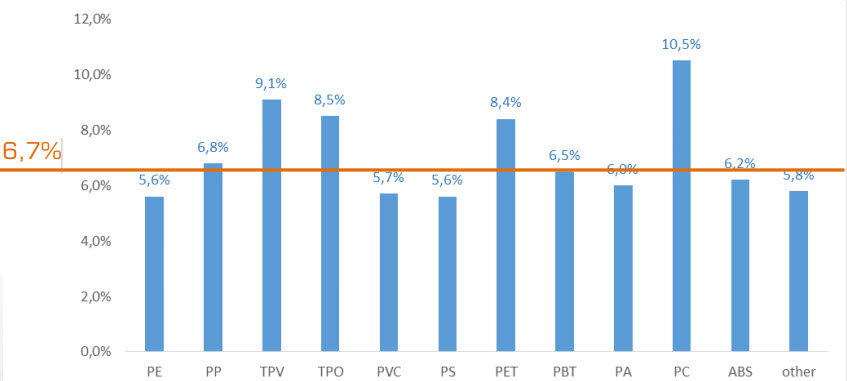

It is estimated that in 2018 2.125 million tons of compounds of all kinds were consumed. It is forecasted that in the period 2019 to 2026, this market will continue to grow with a cumulative annual growth rate of 6.7% and reach 3,563 million tons by 2026.

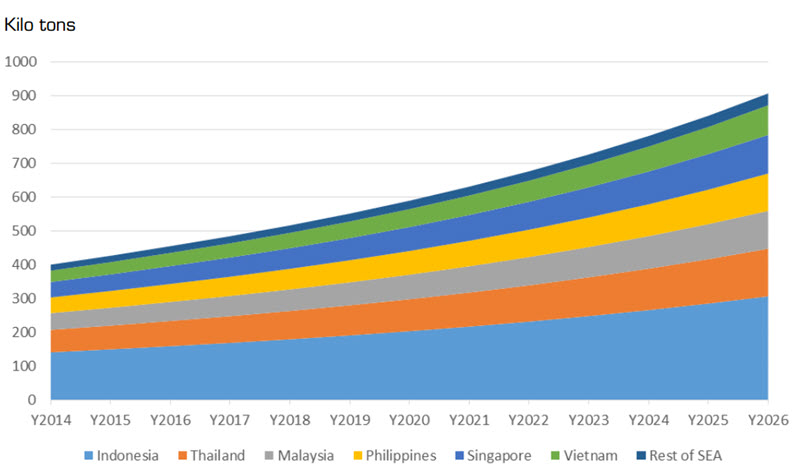

All types of compounds on the base resins have an annual cumulative growth in the period of 2019 - 2026. This is the "expansion" of the market. Although the ratio of PE and PP compound is not high, the absolute number is still the highest because the market of these two groups is the largest, accounting for more than 50% of the total compound output. The compound columns higher than the line have a higher growth rate than the industry average.

All types of compounds on the base resins have an annual cumulative growth in the period of 2019 - 2026. This is the "expansion" of the market. Although the ratio of PE and PP compound is not high, the absolute number is still the highest because the market of these two groups is the largest, accounting for more than 50% of the total compound output. The compound columns higher than the line have a higher growth rate than the industry average.

2. Volume based on countries

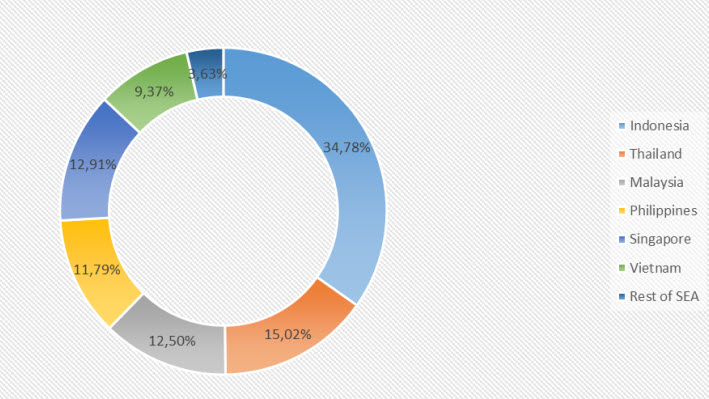

Forecast of compound output based on countries in 2026

The difference in growth brings about different structures of the country's compound market. Vietnam and the Philippines increased their structure while Indonesia, Thailand, and Malaysia decreased their proportion. It is forecasted that during the period 2019 to 2026, this market will continue to grow with a cumulative annual growth rate of 8.9% and reach $6.7 billion by 2026. The growth rate of value is higher than that of volume showing that the value/selling price of the compound tends to increase.

Differences in growth result in different compositions of the compound market by country. Vietnam and Singapore have a higher growth rate than the regional average, so increasing the proportion of the contribution of the market value to the compound market increases the structure. Indonesia, Thailand, and Malaysia reduced their proportions.

3. Volume based on plastic types

The proportion of PE compound decreased, and that of PP compound was lower than that of the volume. These are two common compound groups and have lower values than other groups.

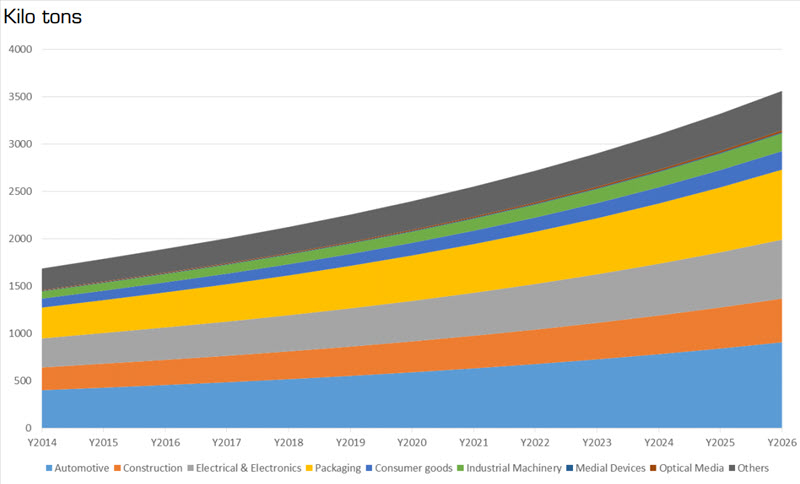

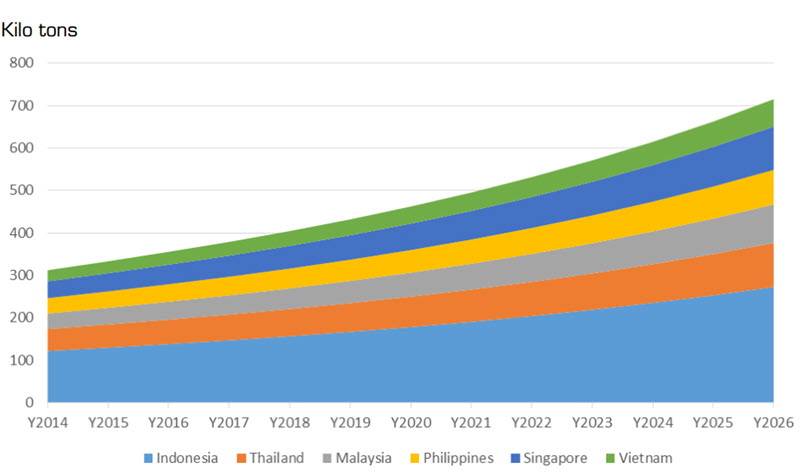

4. Volume based on application

The automotive, electric & electronic, and packaging industries are the three largest compound consumption applications in Southeast Asia. These three groups account for 62% of total consumption.

Related:

- Black masterbatch market report (estimated to 2030)

- What opportunities for masterbatch manufacturer in Vietnam penetrating Indian market?

- Why are UV Masterbatches expected to be a key product for the Indian market?

- Is white masterbatch dominating the global masterbatch industry?

II. Market segmentation by the base resin

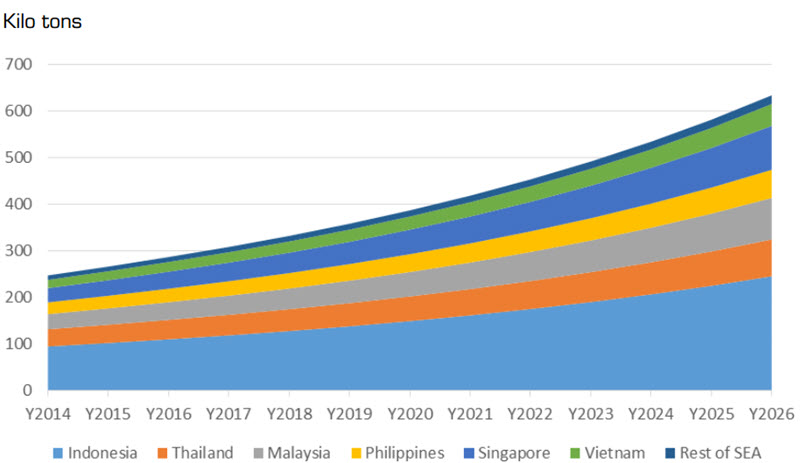

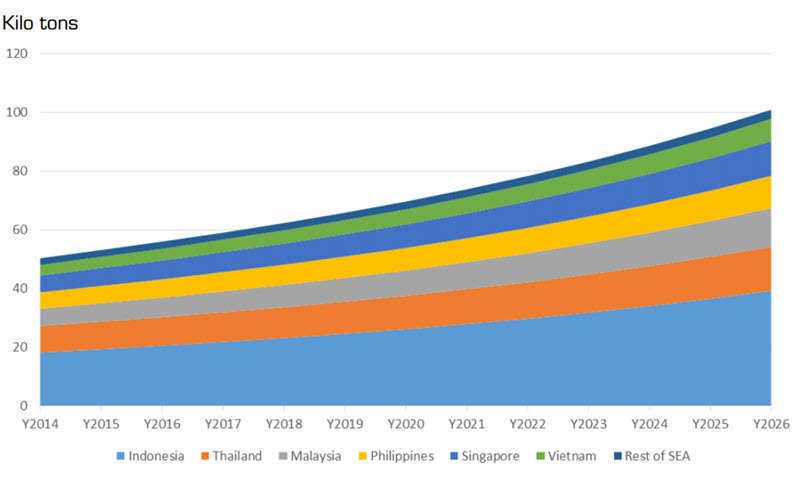

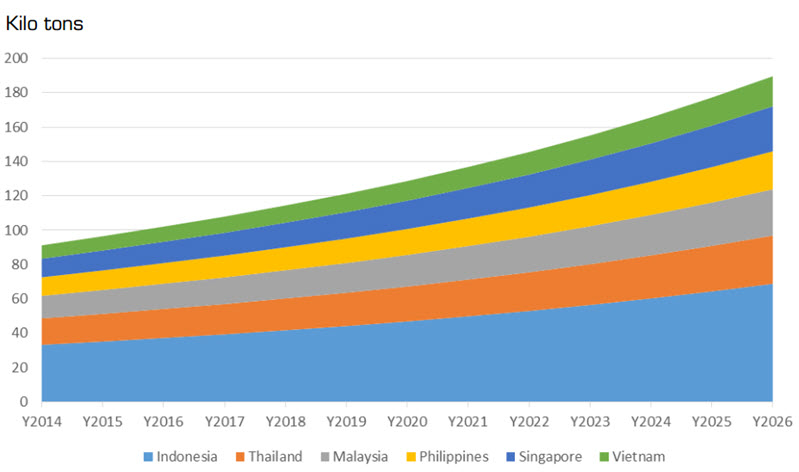

1. PE compound

PE compound is estimated to reach 445,900 tons in 2018 with a value of USD 759.6 million. This market segment accounts for about 20.98% of compound output in the region. It is forecasted that by 2026, it will reach 691,600 tons with a value of $ 1.31 billion. The construction industry is a pioneer in the application of PE compounds such as steel pipe coating; connectors; tank & tank, liquid storage, geotextile, and plastic roof...

PE compound is widely used in other industries: blow molding, films, injection molding, rotomolding, and tape manufacturing. Some other specific items such as toys, shampoo bottles, plastic bags, bulletproof vests, and medical equipment.

Vietnam is considered the country with the highest growth rate of PE compound market in the region (7.8%), followed by the Philippines (6.8%). Together, these two countries account for about 20% of total PE compound production in the region.

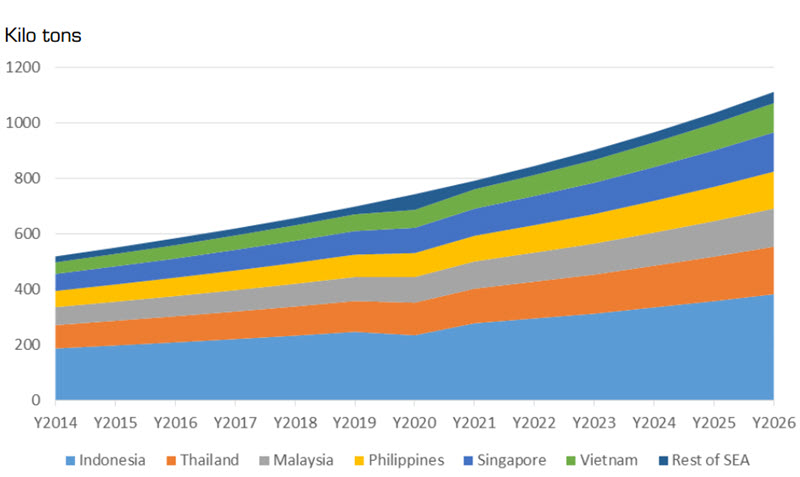

2. PP compound

PP compound is the leading category in the compound industry with the proportion accounting for 30.96% of the market volume. PP compound market capacity in Southeast Asia is estimated at 658,100 tons, bringing in 969 million USD in 2018. It is forecasted to increase to 1,112 million tons (equivalent to 1.9 billion USD) by 2026. The automobile and motorcycle industry is the largest segment of PP compound. Besides, it is also applied in many other industries such as manufacturing and packaging: mineral water bottles, cooking oil, electrical appliances, furniture, luggage storage, or in construction…

Vietnam and Singapore are considered to be the two countries with the strongest market growth for PP compound lines (8.3% and 7.5%). These two countries combined about 20.5% of PP compound production in the region. Indonesia accounts for 35.6% of PP compound production in Southeast Asia.

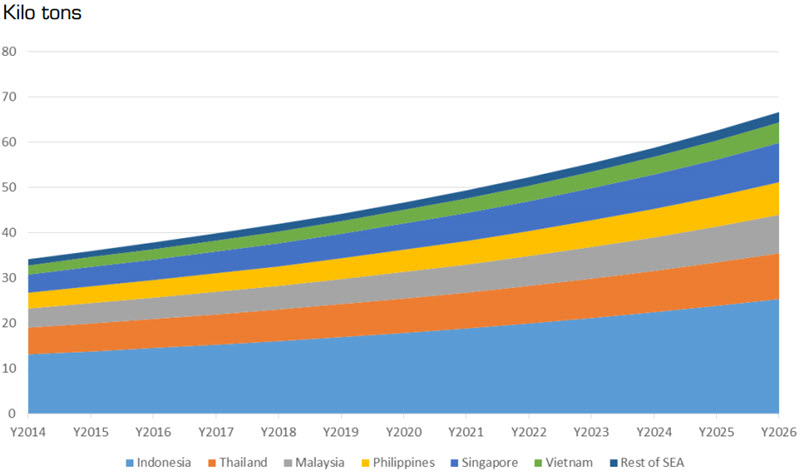

3. PET compound

PET compound is estimated to reach 332,800 tons in 2018 with a value of US$586.5 million, accounting for 15.6% of SEA compound output. Forecast to 2026 will reach the consumption of 634,900 tons bringing a value of $ 1.3 billion. The development of BiO PET is expected to gradually replace the current PET plastic bottle market. PET compound produces water bottles and carbonated drinks. Application as film lining in solar cells. It is also widely used in the garment industry.

Singapore and Malaysia are considered to be the two countries with the fastest growth rates in terms of PET compound market volume (10.1% and 9.1%). Together, these two countries account for 26.5% of PET compound production, while Indonesia and Thailand are estimated to account for 52.6% of PET compound production in Southeast Asia.

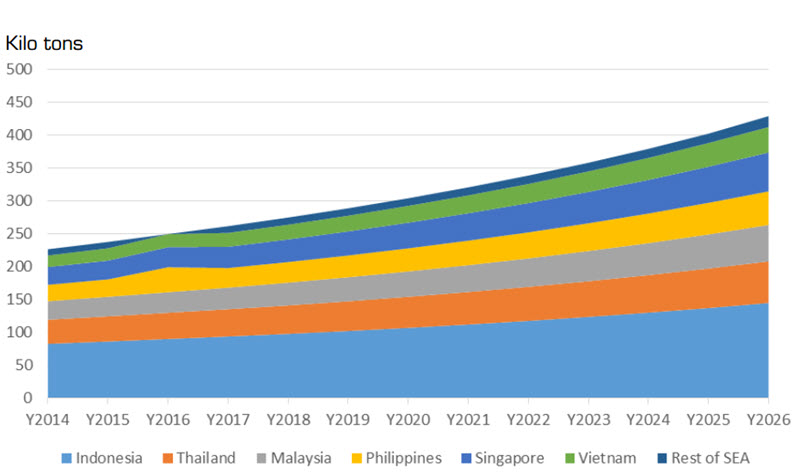

4. PVC compound

PVC compound is estimated to reach 270,000 tons, equivalent to 376.6 million USD in 2018, and will continue to increase to 429,400 tons, equivalent to 786.6 million USD in 2026. This market segment is estimated to account for 12.94% of compound production in the area. PVC compound is applied in many industries such as: films, pipes, sheets, plastic walls, vinyl records, carpets, traffic cones, … The production of bio-based PVC is said to be a project marking the re-growth boom of this market.

Vietnam & Singapore are considered to be the two countries with the fastest growth rates in terms of PVC Compound market capacity (7.1% and 7%), contributing 20.7% of PVC compound output in the region.

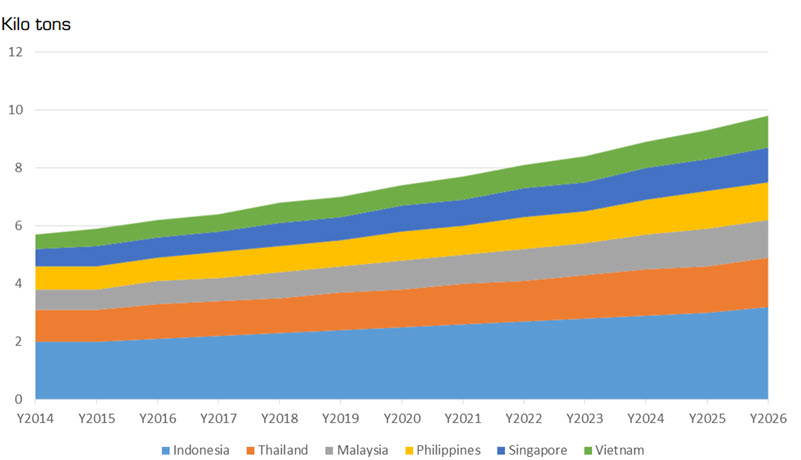

5. PS compound

PS compound has a volume share of about 4.38% of the compound market, estimated at 93,100 tons in 2018, equivalent to a value of USD 169.7 million. This market is growing moderately and is expected to reach 143,600 tons or 327.5 million USD by 2026. The PS compound market is believed to have room for growth in several developing countries in Africa and Asia. The slow decomposition of PS Biodegrades is also the subject of controversy among environmentalists.

The automotive industry uses PS compound for: shock absorbers; roof rails, sunroofs, seats,... in the electrical & electronic industry: foam protects TVs, rice cookers & electronic equipment.

In addition, it is used as insulation packaging, cooler box, egg & fish container, wine corks, etc.

Vietnam and Singapore have the highest growth rates for this group of goods at 7.4% and 6.6% respectively, these two countries are estimated at 19.9% of PS compound output in the region.

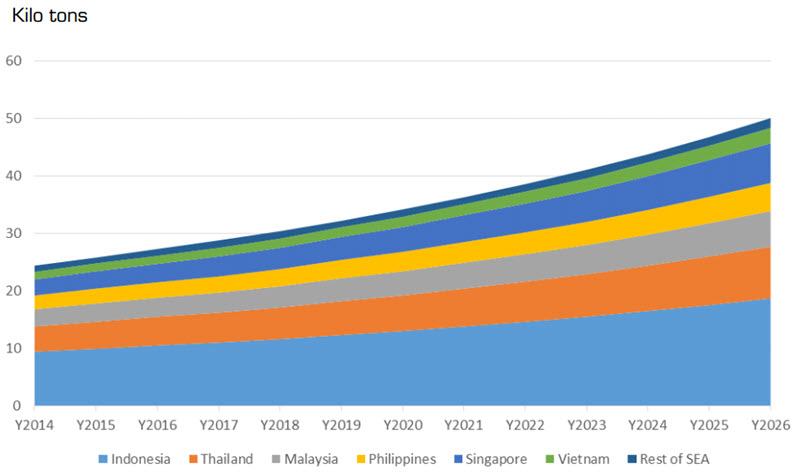

6. ABS compound

ABS compound is estimated at 62,300 tons in the Southeast Asian market, equivalent to 105.4 million USD in 2018, contributing 2.93% of compound output in the region. The market is forecasted to increase to 100,900 tons by 2026, equivalent to 194.2 million USD. The field of Electrical & electronics is the largest market for ABS compound consumption such as computer cases, and office electronic equipment cases. Besides, the automobile and motorcycle industry is expected to bring the highest growth to ABS compounds such as bumpers, interiors, and automotive... to reduce vehicle weight and increase fuel efficiency.

Malaysia, Indonesia, and Vietnam are assessed as the three countries with the highest ABS compound growth rates in the region (7.2%; 6.8%; 6.8%). These three countries contribute 56.5% of ABS compound production in the region.

7. PC compound

The PC compound market in Southeast Asia is estimated at 37,500 tons, contributing 1.76% of the region's total compound output in 2018, bringing in a value of $41.5 million. This market is forecasted to have the highest cumulative growth rate in the period of 2019 - 2026 with a high rate of 10.5% and is forecast to reach 83,500 tons (equivalent to 87.4 million USD) by 2026. Packaging is expected to bring the highest growth opportunities for this product group to replace glass materials.

PC compound is widely used in consumer good industries such as baby bottles/bottles, lampshades, dishes. The electronics and automobile industries have also increased demand for PC compounds in recent years, replacing glass/glass as coatings for production of glass and lamps. In addition, it is widely used for DVD/ bluray disc production. Singapore and Malaysia are said to be the two countries with the fastest growth rate of this commodity group with the rate of 12.2% and 12.1%. These two markets contribute 29.3% of PC compound output in the region.

8. PA compound

PA Compound is estimated at 42,000 tons with a value of 70 million USD in 2018 and will increase to 66,700 tons bringing 118.5 million USD in 2026. This market segment contributes 1.98% of production.

PA compound is used in electronic, consumer and industrial applications. It is used as a replacement for some metal parts on the car (that need temperature/chemical resistance) such as water tank, control panel box PA6, PA66.

Vietnam and Singapore lead in this market growth with an expected rate of 7.2% and 7% per year, accounting for about 18.3% of the region's output.

9. PBT compound

PBT compound is estimated at 30,400 tons, bringing value of 71.7 million USD in 2018 and will increase to 50,100 tons equivalent to 132.8 million USD in 2026.

PBT compound is used in auto accessories: engine covers, brushes. It is also made of electrical connectors, cooling fans, propellers, switches. This material is also commonly used in the sportswear industry for UV protection. Besides, it is also made of toothbrush fibers and computer keyboards.

Singapore and Vietnam are expected to achieve annual growth rates of 8% and 6.8% for this product group, contributing 17.4% of PBT compound output in the region.

10. TPO compound

TPO compound is expected to grow thanks to the application of the construction industry such as insulating roofing, geomembrane. It is also widely used in the automotive field such as bumpers, interior & exterior, car mats, handlebars/throttles.

In 2018, TPO compound is estimated at 27,400 tons, bringing in USD 47.4 million. And it is forecasted that by 2026, it will reach 52,900 tons, equivalent to 88.2 million dollars. Singapore and Vietnam are expected to achieve the highest cumulative growth rates of 9.9% and 9.7% each year for this compound market.

11. TPV compound

TPV compound is a small market, accounting for only 1% of the total volume of the Southeast Asia compound market, reaching about 19,100 tons in 2018 and is forecasted to increase to 38,400 tons in 2026, equivalent to 54 million USD.

This compound type is applied in the automotive industry, used as a substitute for rubber (rubber seals, rubber washers), air conditioning hoses, power jacks, dampers, plugs. It is also used in construction and electrical appliances to replace some rubber parts.

Malaysia and Singapore are expected to achieve annual growth rates of 9.7% and 9.6% for this compound market.

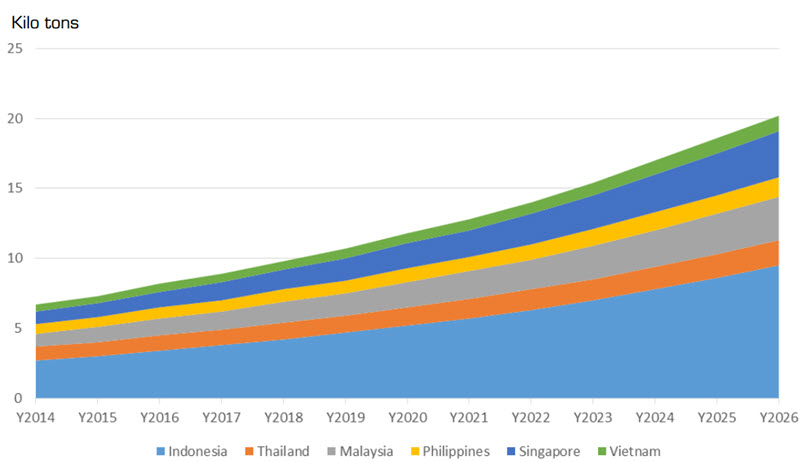

III. Market segmentation by application

1. Automotive

Automobile and motorcycle industry is the largest compound consuming industry, accounting for 24.26% of compound output. It is estimated at 515,700 tons, bringing in 821.4 million USD in 2018 and is forecasted to reach 1.65 billion USD in 2026, equivalent to 905,900 tons. Vietnam is considered to be the country with the highest cumulative growth rate in the region (8.6%) with consumption of 45,300 tons in 2018 bringing 59.9 million USD.

PP and PET compounds are the most widely used in this industry such as: body shells, levers, shock absorbers, locks, front grilles, cladding, ledges, shell joints. In addition, other details such as seats, insulation film made from PU, box / control panel PA6 / PA66. Some other details also need compound such as seat belts, straps, braces, foot mats, belt loops, bearing washers.

2. Packaging

Packaging is the second largest consumer of compound (accounting for 19.8% of output), estimated at 420,800 tons, bringing in 707.7 million USD in 2018 and will reach 1.46 billion USD in 2026, equivalent to 740,200 tons.

Singapore, Malaysia and Vietnam are considered to be the countries with the fastest growth rates for the compound industry in this field. The development of the packaging market in Southeast Asia depends on the consumption of China, India, Germany, USA, Brazil.

High demand in PP packaging market drives and is a major contributor to industry growth. PP compound offers a cost-effective solution in packaging production, and increases the quality, toughness, mechanical properties, and usability of the final product.

3. Electricity, electronics

The third largest application market segment is Electricity & Electronics (accounting for 17.97% of the market), with a value of USD 616.2 million (equivalent to 382,000 tons) in 2018. And it is forecasted to grow 6.3% to reach 623,700 tons equivalent to USD 1.16 billion in 2026. Plastic compound for this sector in Southeast Asia is witnessing great growth due to increasing demand for portable, small and light devices. .

Vietnam and Singapore have the highest compound annual growth rates, (7.4% and 7.2%), these two markets account for only 20% of Asean. Indonesia is the largest national market with a share of ~35.5% of the whole block.

4. Building & construction

The construction industry is estimated to consume 294,100 tons of compound output in 2018 and bring in 478.3 million USD (accounting for 13.84% of the market). This market is forecasted to continue to increase with a compound growth index of 5.8 % to 2026, reaching 461,700 tons equivalent to 910.3 million USD

PVC, ABS, PE and PP compound are used in many different applications such as: sheet

insulation, wall panels, pipes, window frames, roofs, cables. Plastic compound can replace some parts made from metal, concrete, glass, heavy metal, wood to increase some features of the final product. Besides, it is also used in the production of troughs / lampshades

electricity, glass doors, soundproof walls.

Vietnam accounts for only about 8.7% of the market volume but is the country with the highest growth rate in the region. Indonesia is the largest market accounting for 34.9% of the total market capacity in Southeast Asia by compound volume.

5. Consumer good

The consumer goods segment consumed 110,900 tons of compound, bringing in 203.9 million USD in 2018. It is forecast that the consumption of this market will reach 196,200 tons, bringing 413.8 million USD in 2026.

Singapore accounts for 12% of the total market in this segment but has the highest growth rate. Indonesia still accounts for ~35% of the compound market volume for consumer goods. Vietnam is the smallest in this segment, accounting for 8.4% of the market.

Consumer electronics brought significant growth to the compound market thanks to smart devices, smartphones, tablets, and home appliances. Garment also promotes the development of compound (PET compound).

6. Industrial machinery and equipment

The market for industrial machinery and equipment that consumes plastic compounds is estimated at 101,600 tons, equivalent to 177 million USD in 2018. The cumulative market growth is 8.1%, is expected to reach 188,800 tons in 2026, equivalent to worth 384 million USD.

7. Medical equipment

The medical equipment market consumed 7,000 tons of compound in 2018 equivalent to 13.3 million USD and is expected to increase to 10,200 tons, equivalent to 22.5 million USD in 2026. Development of medical technology, population Aging drives the compound's growth in this industry.

Plastic compound provides solutions in terms of biology, optics, and economics in creating medical devices. However, the application volume is very small.

8. Electronic storage device

This is also a market with a low volume of compound consumption, estimated at 10,100 tons, bringing a value of 11.6 million USD in 2018 for the whole Southeast Asia region. It is expected that by 2026 production will more than double to 20,900 tons. PC compound is often applied in the production of compact discs, Blu-ray discs, DVDs.

IV. Conclusion

Plastic compound market in Southeast Asia, estimated at 2.15 million tons equivalent, values $3.4 billion in 2018. The market is on an uptrend with a compound annual growth rate of 6.7% in volume and 8.9% in value between 2019 and 2026.

The market is divided into market segments according to the following criteria:

- If segmented by country: Indonesia is the largest market in the region, accounting for about 35% of the whole region. Vietnam is assessed as the country with the highest growth rate of this industry with an annual "expansion" in the period of 7.9% in output and 10.7% in market value, accounting for about approx. 9.4% of output and contributed 6.9% of value

regional compound market.

- If segmented by base plastic: PP compound is the largest market segment, accounting for about 30.96% of the plastic compound market, equivalent to 658 000 tons and bringing 28.5% of the total market value, equivalent to 969 million USD in 2018. The next segment in terms of volume is PE compound (19.4%), PET compound (17.8%) and PVC (12%).

- If segmented by application: The automobile and motorcycle industry consumes the largest compound volume, accounting for about 24.3% of the total compound consumption, equivalent to 516 thousand tons, and worth 821 million USD in 2018. The next segment is Packaging (19.8%); electricity & electronics (17.97%) and construction (13.8%).

According to an internal report of Europlas.