Related:

- Southeast Asia Plastic Compounding Market (Estimated to 2026)

- What opportunities for masterbatch manufacturer in Vietnam penetrating Indian market?

- Why are UV Masterbatches expected to be a key product for the Indian market?

- Is white masterbatch dominating the global masterbatch industry?

1. What is black masterbatch?

Black masterbatch (hereinafter abbreviated as Black Masterbatch) is an additive made up of carbon black pigment, resin, and additives. Black Masterbatch adds the black color to polymer raw materials during plastic processing. Black Masterbatchs can be tailored to suit color, temperature, or UV protection requirements.

Regarding classification, Black Masterbatch can be classified according to the origin of plastic materials, the most common are PE, PP, and PS. Out of them, PE-based Black Masterbatch seems to be the most favorable.

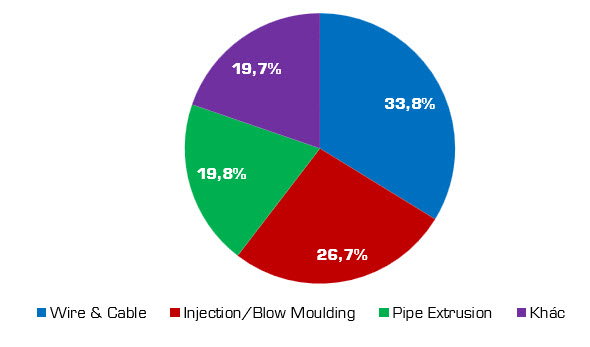

In terms of application, Black Masterbatch can be used for plastic wire and cable, extrusion pipe, film extrusion, and blow/injection molding. The application of plastic wire/cable and blowing/injection molding accounts for the largest proportion.

2. Market volume

According to a report by Global Info Research, the Black masterbatch market capacity is determined to be around 2.70 billion USD in 2019. Another Prudour report shows that the forecast market capacity for 2018 is 2.88 billion USD while a report by Market Watch shows that the market capacity in 2020 is forecast at 2.75 billion USD. Although the nuBlack Masterbatchers are varied, they all fluctuate around 2.70 - 2.80 billion USD. This shows that the Black masterbatch market capacity is in this range.

Regarding market growth, Global Info Research and Market Watch forecast an average growth of about 0.2% per year to US$2.79 billion by 2026. Some other sources such as Prudour or Markets At Markets give a forecast figure of about 4.9 - 5.4%. However, this nuBlack Masterbatcher may not take into account the impact of Covid-19 or does not be specific, so it is not convincing.

The global Black Masterbatch market is expected to grow steadily during the forecast period along with demand coming from emerging economies, due to the favorable economic environment. Black Masterbatch is used in the plastics, automotive, agriculture, packaging,... industries. In particular, the increasing use of plastic substitutes for metals in the automotive industry and strong demand in this sector will contribute to the driving force of the Black Masterbatch market. Another important application of Black Masterbatch is film extrusion. This is a popular method to produce plastic films, especially for the packaging industry, which will further boost the demand for Black Masterbatch.

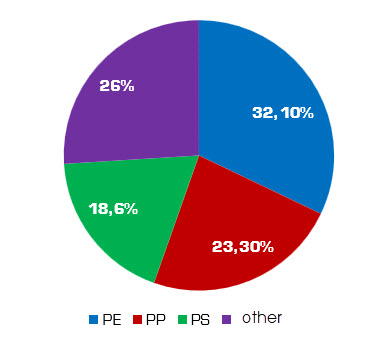

3. Market segmentation by the base resin

According to Prudour's report, PE-based black masterbatch holds the largest market share with 32.1%. Followed by PP-based black masterbatch with 23.3% market share and PS-based black masterbatch with 18.6% market share. The remaining 26.0% belongs to black masterbatch derived from other plastic such as PS, PF, etc..

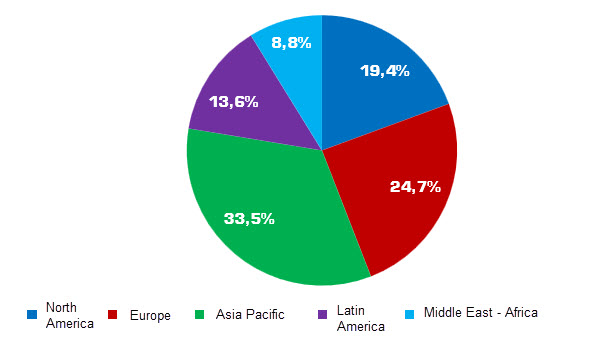

4. Market segmentation by region

According to Prudour's report, the largest market share is Asia - Pacific with 33.5% of the market. It is followed by Europe, North America, Latin America and the Middle East - Africa with market shares of 24.7%, 19.4%, 13.6% and 8.8%, respectively.

Global Info Research gives a different Black Masterbatch when Europe accounts for the largest share with 29.5%. Next is Asia and North America accounting for 52.2% and 10.68%, respectively, of which China accounted for 24.8%. The remaining 7.7% is distributed to other regions.

Based on the 2015 Masterbatch market report of Markets And Markets, the national markets in each region have the following breakdown:

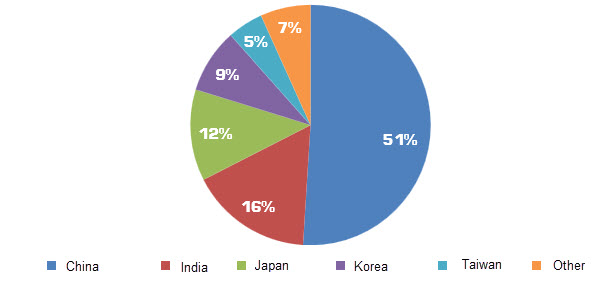

a. Asia Pacific

In the Asia-Pacific region, China has the largest market share (51%), outperforming other markets in the region. The reason is that this is a large market with many resources, attracting many organizations to participate in production and transactions. The boom in the plastics industry has boosted demand in the country a lot. However, the development of other methods for coloring plastics can be considered a risk to this market.

Although it is also a market of billions of people, India only accounts for 18% of the Black Masterbatch market share in Asia - Pacific, ranking 2nd in the region. India is also a country with a high growth rate thanks to investment in the manufacturing industry and demand fueled by a developing economy. In third place is Japan with a 12% market share. The demand for aesthetics as well as high technology promotes the development of plastic additives, including Black masterbatch. However, the Japanese economy faces many difficulties of the demand for plastic substitutes, such as paper, which puts pressure on the development of Black Masterbatch in the country.

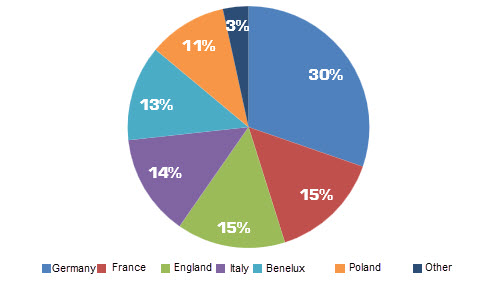

b. Europe

Germany is the country with the largest market share of Black Masterbatch in Europe, accounting for 30% of the old continent market. This position is contributed by the huge plastic manufacturing and processing industry in the country, along with other plastic-using industries. France is the second largest country in Europe with 15% of the regional market share. Despite having a large plastic manufacturing industry, the country is facing the saturation of the domestic plastic industry. In third place is the UK with 15% of the European Black Masterbatch market share. The growth of the plastics industry in the UK is supported by the demand for high-quality plastics which largely contributes to this position.

c. North America

The US occupies an almost absolute market share in North America with 81% of the regional market. Demand for Black Masterbatch is driven by the huge plastic industry in the country. However, investors in the US are looking to Asia-Pacific and Latin America, where production pace and demand are stronger, slowing demand growth in the US. Mexico ranks second in the region with an 11% market share in North America, thanks to strong manufacturing demand in the growing economy. The rest is Canada with an 8% market share in North America, which is facing slow growth.

d. Latin America

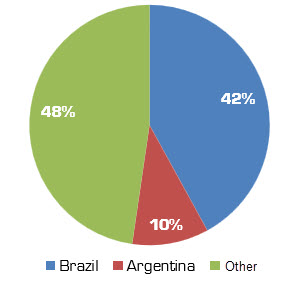

Brazil holds the largest market share in the region with 42% of Latin America Black Masterbatch market. The developing nation's demand for Masterbatch, including Black Masterbatch, is driven by industries that use plastics. Besides, many investors are entering the Brazilian market through mergers, which is also a driving factor for the market. Argentina is also a notable market in Latin America. Although it is a small market and accounts for only 10% of the regional market share, Argentina is considered to have a good development when the development of plastic industries has driven the demand for Black Masterbatch.

5. Market segmentation by application

According to Prudour's report, wire/cable-making application holds the largest market share with 33.8%. Application for blowing/injection molding ranks second with 26.7% market share. Black Masterbatch for pipe extrusion accounts for 19.8% of the market while the rest of the applications account for about 19.7% of the market share.

EuP Marketing Dep’t.,